There is significant evidence that AI will have a huge impact on financial services – whether that is Robo-Traders, Robo-Advisors, Customer Chat Bots, and Research Assistants, with real-world use-cases being launched globally.

In Financial Services JP Morgan continues to demonstrate confident and innovative use of AI.

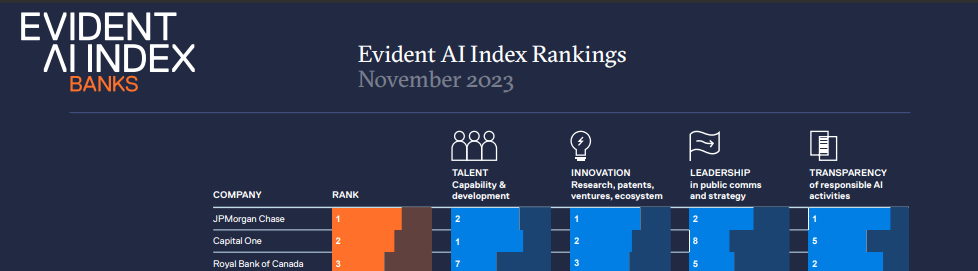

JP Morgan Ranks #1 According on Evident Insights

You may have never heard of Evident Insights, and I certainly hadn’t prior to conducting research for this article. Interestingly, they produce an annual index of the state of AI in Financial Services – self-termed as “The global standard benchmark of AI Maturity”.

According to this independent research, JP Morgan has been top-of -the-pile for AI for the second year on the trot (Capital One and Royal Bank of Canada take 2nd and 3rd placings respectively). The top three within this index have also accelerated away from the rest of the pack:

Incidentally, the same report reveals that there is some distance between the NORAM banks, and those in EMEA.

What is the ranking based on?

As can be seen from the above diagram, there are 4 pillars with weightings for success in each pillar:

- Talent – 45%

- Innovation – 30%

- Leadership – 15%

- Transparency – 10%

At first, I had wondered why talent took such a large slice of the ranking weight. However, research by UK Finance clearly outlines “Technical Maturity and constraints” as being second on the list of inhibitors for both Generative AI and Predicate AI in FS (first place is taken by Data, which will be discussed later). That makes sense, considering you need to have the right talent before you bring in the leadership, and can perform innovation!

The “skills crunch” is supported by reporting by efinancialcareers. They report that AI Product Managers can command salaries up to $900k – and hedge funds are paying top AI talent straight out of university (college to our US cousins!) $320-$430k. These numbers are eye-popping and are clearly targeted to the very top talent – to illustrate this, Glassdoor conversely report that a typical AI Engineer salary is c. $120k

So, what are JP Morgan doing around talent?

Given the importance of AI Talent in Financial Services, what are JP Morgan doing in that area?

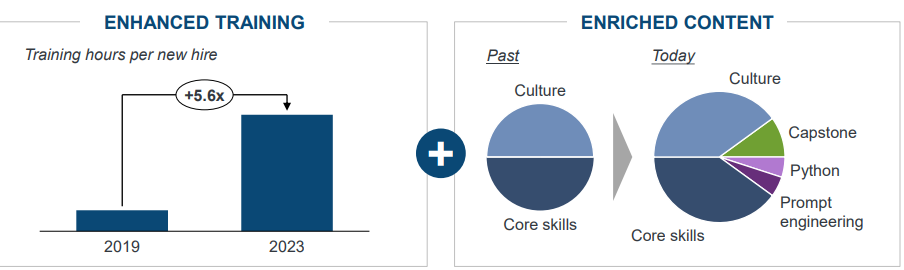

- First, as discussed during an investment call in May this year, JP Morgan is embedding Prompt Engineering into the on-boarding process for new hires across their asset and wealth management division. This shows a clear investment in talent, and a recognition of how important AI will be to their future operations.

- Secondly, according to Mary Erdoes (CEO of Chase’s asset and wealth management division), they have increased training hours by 500% between 2019 and 2023 across all technologies. Although Prompt Engineering is a small slice of overall training, the increase in training hours is startling nonetheless:

- Thirdly, to provide leadership, they introduced a new role of “Chief Data and Analytics Officer” in 2023, partly to handle AI initiative.

And what is the talent doing?

As reported by the Financial Times [paywall article] in July, 2024 – they have started rolling out a GenAI product named “LLM Suite” to 50,000 users (15% of their staff). The product’s objective is to perform the role of analysts, and for “general use”. The Times also reports that this is one of the largest uses of LLMs in Wall Street.

To release a product across 15% of their workforce is a bold move, and a significant vote of confidence in the future of AI. This is reinforced by the confident views of Chase’s leadership that AI is here to stay.

During an interview with CNBC in February, Chase’s CEO addresses hype around previous “technology bubbles” in a definitive statement:

“This is not hype. This is real. When we had the internet bubble the first time around, that was hype. This is not hype, it’s real”

In 2020, Jamie Dimon stated that the bank was just “scratching the surface” of AI possibilities, so we can expect to see rapid development in the future.

Takeaways

Data availability is paramount

As has been demonstrated through the huge volumes of data required to train the LLMs many of us use on a daily basis (such as ChatGPT, Antrhropic Calude, Google Gemini, et al.) – source data is a paramount driver. Indeed, the same research by UK Finance reports the availability of Data as the #1 potential blocker for AI innovation.

It follows, then, that Financial Services (with huge volumes of publicly available and corporate data) is ripe for AI. Given the scale of JP Morgan, it is reasonable – then – that their scale alone provides them with the volumes of data necessary to build accurate AI models and to stay ahead of their smaller rivals.

Note: other industries with large volumes of data, such as Healthcare, are also seeing the same opportunities for AI optimisation.

Attracting the right talent is key

Large institutional and investment banks are leading in the AI race. Given competitiveness in the AI Talent market, deep pockets help to recruit the very best talent needed to stay ahead of the race (perhaps I should call it a marathon given the number of competitors)

Conclusion

AI is here to stay, and Financial Services organisations such as JP Morgan are race leaders – given the level of technical skills they already have on-tap, they can reskill their large footprint to focus on AI innovation.

Keeping abreast of Financial Services strategies, approaches, and use-cases can, therefore, provide direction for organisations that can’t afford the same level of experimentation, or to pay to learn failures, that Financial Services organisations can absorb.

This post is a personal opinion and in no way reflects the opinion of anyone I work for